Configuration Steps in ‘SAP FI’

This post will describe you briefly, which basic configuration steps to be followed for SAP FI module implementation.

Other detailed configuration & business transaction related posts would be updated separately in same blog.

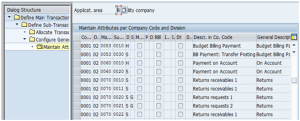

1. Enterprise Structure

1.1. Description: Maintain Enterprise Structure

Transaction Code: SPRO

Menu Path: IMG > Enterprise Structure > Definition > Financial Accounting

Client dependent settings: Yes / No

Active Settings:

In this step, you create the organizational units for the following components:

• G/L Accounting

• Accounts Receivable

• Accounts Payable

You only define organizational units which are relevant for one component when configuring the respective components

1.2. Description: Define Company Code

Transaction Code: SPRO

Menu Path: IMG > Enterprise Structure > Definition > Financial

Accounting > Edit , Copy Delete, Check Company Code Client dependent

settings: Yes / No

Active Settings:

The company code is an organizational unit used in accounting. It is

used to structure thebusiness organization from a financial accounting

perspective

2. Financial Accounting Basic Settings (New)

2.1. Financial Accounting Basic Settings (New)

2.1.1. Description: New Ledgers

Transaction Code: SPRO

Menu Path: IMG à Financial Accounting (New)à Financial Accounting Basic

Settings (New) à Ledgers

Client dependent settings: Yes / No

Active Settings:

In the following activities, the settings for the central objects in financial accounting are defined

2.1.1.1. Description: Define Field Status Variants

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Ledgers > Define Field Status

Variants

Active Settings:

In this activity you can define and edit field status variants and

groups. You group several field status groups together in one field

status variant. You assign the field status variants to a company code

in the activity

Assign Company Code to Field Status Variants . This allows you to work with the same field status groups in any number of company codes.

You can also define and process field status groups. You must define a

field status group in the company code-specific area of each G/L

account. The field status group determines which fields are ready for

input, which are required entry fields, and which are hidden during

document entry. Bear in mind that additional account assignments (i.e.

cost centers or orders) are only possible if data can be entered in the

corresponding fields

2.1.1.2. Description: Assign Company Code to Field Status Variants

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Ledgers > Assign Company Code

to Field Status Variants

2.1.1.3. Description: Maintain Fiscal Year Variant (Maintain Shortened Fisc. Year)

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Ledgers > Fiscal Year and

posting periods > Maintain Fiscal Year Variant (Maintain Shortened

Fisc. Year)

Active Settings:

A

fiscal year consists of several posting periods and if necessary,

special periods that can be posted to after a temporary year-end closing.

You define how your fiscal year is set up in the SAP System by creating a fiscal year variant at client level.

Each company code is assigned a fiscal year variant. Several company codes can use the same fiscal year variant.

In the Fiscal Year variant we can define the following areas

- • how many posting periods a fiscal year has

- • how many special periods you need

- • how the system is to determine the posting periods when posting

2.1.1.4. Description: Assign Company Code to a Fiscal Year Variant

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Ledgers > Fiscal Year and

posting periods > Assign Company Code to a Fiscal Year Variant

Active Settings:

Every Company code has to be assigned to Fiscal Year Variant.

2.1.1.5. Description: Open and Close Posting Periods

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Ledgers > Fiscal Year and

posting periods > Open and Close Posting Periods

Active Settings:

Every Company code has to be assigned to Open and Close Posting Periods Variant.

2.1.1.6. Description: Define Variants for Open Posting Period

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Ledgers > Fiscal Year and

posting periods > Open and Close Posting Periods > Define

Variants for Open Posting Period

Active Settings:

In this activity, you can define variants for open posting periods

2.1.1.7. Description: Assign Variants to company code

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Ledgers > Fiscal Year and

posting periods > Open and Close Posting Periods > Assign

Variants to company code

Active Settings:

In this activity you specify for each variant which posting periods

are open for posting. Two intervals are available for doing this (period

1 and period 2). For every interval, enter a lower period limit, an

upper period limit and the fiscal year.

You close periods by selecting the period specifications so that the periods to be closed are no longer contained.

Posting Period Variants and the Account type used are as Follows

+ Valid for all account types

A Assets

D Customers

K Vendors

M Materials

S G/L accounts

2.1.1.8. Description: Enter global parameters

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial Accounting Basic Settings (New) > global parameters for

Company Code > Enter global parameters

Active Settings:

In the following steps other structures and master records and

control specification for each company code in Financial accounting is

defined. Most Important, specification of the company code can be

over-viewed any point of time. This includes Chart of Accounts Fiscal

year variant, FM Area, Field Status Variant, posting period Variant Etc.

2.1.2. Description: Documents

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial Accounting Basic Settings (New) > Documents

2.1.2.1. Description: Documents

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Documents > document types

Active Settings

In this IMG activity, you have to define for your

leading ledger the

document types for the documents. You do this in the entry view and assign at the same time a number range interval to the document types.

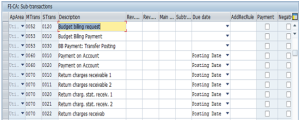

Document type for GL View with their Number Range

2.1.2.2. Description: Number Ranges

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Documents > Number Ranges

Active Settings:

A number range must be assigned to each document type in the SAP

System. Via the document types, you distinguish the postings according

to the different business transactions, for example customer payment,

vendor credit memo, and so on. To store documents separately according

to

document types, you must assign a separate number range to each document type, for example to invoices or to credit memos.

In the following activities:

- • You define your document number ranges.

- • You can determine which intervals of document number ranges are to be copied from

one company code into another.

- • You can determine which intervals of document number ranges are to be copied from

one fiscal year into another.

In this activity you create

number ranges for documents. For each number range you specify

(among other things):

- • a number interval from which document numbers are selected

- • the type of number assignment (internal or external)

You assign one or more

document types to each number range. The number range becomes

effective via the document type specified in document entry and posting.

2.1.2.3. Description: Define Posting Keys

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Documents > Define Posting Keys

Active Settings:

In this activity you define posting keys. Users specify a posting key before entering a line item.

The posting key controls how the line item is entered and processed.

For each posting key, you define among other things:

- • which side of an account can be posted to,

- • which type of account can be posted to, and

- • which fields the system displays on the entry screens and whether an entry must be made (field status).

2.1.2.4. Description: Document Change Rules, Document Header

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Documents > Rules for changing documents > Document Change Rules, Document Header

Active Settings:

In this activity, you determine under which circumstances fields

within posted documents can be changed. For a number of fields, the

system itself determines that they can no longer be changed after

posting. This includes all fields which are central to the principles of

orderly accounting, for example, the amount posted and the account.

The system also prevents the update objects from being changed in

documents which have already been posted, independent of the document

change rules. Update objects are elements in the system for which

transaction figures or line items are updated, for example, business

area or cost centers (if cost center accounting is used in the SAP

system). Update objects are entered as additional account assignments

during posting.

2.1.2.5. Description: Document Change Rules, Line Item

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Documents > Rules for changing documents > Document Change Rules, Line item

Active Settings:

In this activity, you determine under which circumstances fields within posted documents can be changed.

For a number of fields, the system itself determines that they can no

longer be changed after posting. This includes all fields which are

central to the principles of orderly accounting, for example, the amount

posted and the account.

The system also prevents the update objects from being changed in

documents which have already been posted, independent of the document

change rules.

Update objects are elements in the system for which transaction

figures or line items are updated, for example, business area or cost

centers (if cost center accounting is used in the SAP system). Update

objects are entered as additional account assignments during posting.

2.1.2.6. Description: Define Tolerance Groups for Employees

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Documents > Tolerance Groups > Define Tolerance Groups for Employees

Active Settings:

In this activity, you predefine various amount limits for your employees with which you determine:

- • the maximum document amount the employee is authorized to post

- • the maximum amount the employee can enter as a line item in a customer or vendor

account

- • the maximum cash discount percentage the employee can grant in a line item

- • the maximum acceptable tolerance for payment differences for the employee.

Payment differences are posted automatically within certain tolerance

groups. This way the system can post the difference by correcting the

cash discount or by posting to a separate expense or revenue

account.

In this respect you define:

- • the amounts or percentage rates up to which the system is to

automatically post to a separate expense or revenue account if it is not

possible to correct the cash discount or

- • up to which difference amounts the system is to correct the cash

discount. In this case the cash discount is automatically increased or

decreased by the difference. using tolerance groups.

You can also additionally differentiate these settings by company

code. Since the same rules usually apply to a group of employees, enter

the values for employee groups. You can then enter amount limits and

tolerances per employee group and company code.

2.1.2.7. Description: Define Texts for Line Items

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Documents > Define Texts for Line Items

Active Settings:

In this activity, you can store texts under keys which can be

transferred to the line item. When entering a document, the key is

entered in the text field.

2.1.2.8. Description: Activate Extended Withholding Tax

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial Accounting Basic Settings (New) > global parameters for

Company Code > Tax settings > Activate Extended Withholding

Tax

Active Settings:

Extended With Holding Tax offers the following features.

- • Withholding tax for accounts payable

- • Withholding tax calculation during payment

- • Withholding tax code per vendor line item

- • Multiple withholding taxes per customer or vendor line item

- • Withholding tax calculation for partial payments

- • Enhancements in withholding tax calculation

- • Withholding tax calculation during invoice entry and during payment

2.1.2.9. Description: Extended Withholding Tax

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Withholding Tax > Extended Withholding Tax

2.1.2.10. Description: Basic Settings

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Withholding Tax > Extended Withholding Tax > Basic Settings

2.1.2.11. Description: Check Withholding Tax Countries

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Withholding Tax > Extended

Withholding Tax > Basic Settings > Check Withholding Tax

Countries

Active Settings:

In this activity you check the withholding tax countries.

The withholding tax country is needed for printing the withholding

tax form. Since the list of country IDs prescribed by law is different

from the list in the system, you have to define the withholding tax

countries again.

2.1.2.12. Description: Define official Withholding Tax Codes

Transaction Code: SPRO

Menu Path: IMG > Financial Accounting (New) > Financial

Accounting Basic Settings (New) > Financial Accounting (New) >

Financial

Accounting Basic Settings (New) > Withholding Tax > Extended

Withholding Tax > Basic Settings > Define official Withholding

Tax Codes